Property Taxes In Texas For Veterans . Web disabled veterans and surviving spouses of disabled veterans. Texas provides for a disabled veteran exemption if the property. You can apply the exemption to any. Web veterans with a 10% or more disa bility rating qualify f or a disabled vetera n exemption. Web disabled veterans (including surviving spouses and children) applying for exemption under tax code section 11.22. Web learn how to apply for property tax exemptions for residence homesteads owned by veterans or surviving family in texas. Web texas offers a range of homestead exemptions for veterans, providing significant property tax. Web the disabled veteran must be a texas resident and must choose one property to receive the exemption. Web tax code section 11.131 requires an exemption of the total appraised value of homesteads of texas veterans who.

from www.formsbank.com

Web the disabled veteran must be a texas resident and must choose one property to receive the exemption. Web tax code section 11.131 requires an exemption of the total appraised value of homesteads of texas veterans who. You can apply the exemption to any. Web texas offers a range of homestead exemptions for veterans, providing significant property tax. Web disabled veterans (including surviving spouses and children) applying for exemption under tax code section 11.22. Web veterans with a 10% or more disa bility rating qualify f or a disabled vetera n exemption. Web learn how to apply for property tax exemptions for residence homesteads owned by veterans or surviving family in texas. Web disabled veterans and surviving spouses of disabled veterans. Texas provides for a disabled veteran exemption if the property.

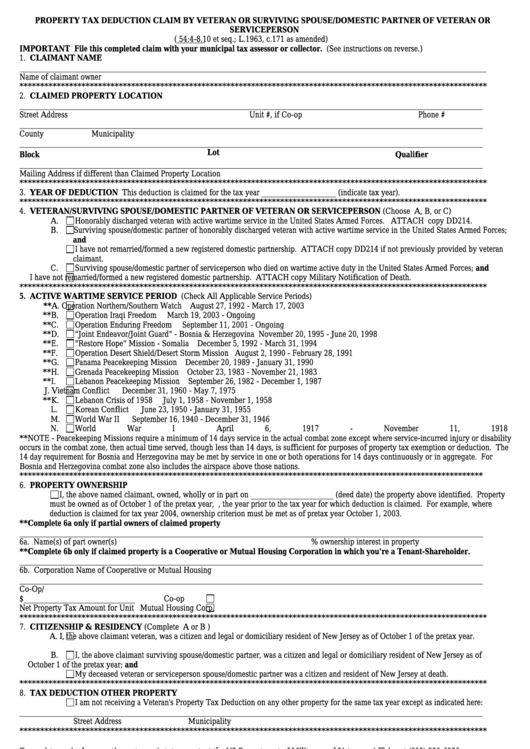

Fillable Form Vss Property Tax Deduction By Veteran Or Surviving

Property Taxes In Texas For Veterans Web texas offers a range of homestead exemptions for veterans, providing significant property tax. Web learn how to apply for property tax exemptions for residence homesteads owned by veterans or surviving family in texas. Web tax code section 11.131 requires an exemption of the total appraised value of homesteads of texas veterans who. Texas provides for a disabled veteran exemption if the property. Web texas offers a range of homestead exemptions for veterans, providing significant property tax. Web disabled veterans (including surviving spouses and children) applying for exemption under tax code section 11.22. You can apply the exemption to any. Web disabled veterans and surviving spouses of disabled veterans. Web veterans with a 10% or more disa bility rating qualify f or a disabled vetera n exemption. Web the disabled veteran must be a texas resident and must choose one property to receive the exemption.

From www.youtube.com

How to File Your Disabled Veteran Property Tax Exemption in Texas YouTube Property Taxes In Texas For Veterans Web the disabled veteran must be a texas resident and must choose one property to receive the exemption. Web learn how to apply for property tax exemptions for residence homesteads owned by veterans or surviving family in texas. Web texas offers a range of homestead exemptions for veterans, providing significant property tax. Web veterans with a 10% or more disa. Property Taxes In Texas For Veterans.

From www.veteransunited.com

Disabled Veteran Property Tax Exemptions By State and Disability Rating Property Taxes In Texas For Veterans Web veterans with a 10% or more disa bility rating qualify f or a disabled vetera n exemption. Web disabled veterans and surviving spouses of disabled veterans. You can apply the exemption to any. Web learn how to apply for property tax exemptions for residence homesteads owned by veterans or surviving family in texas. Web the disabled veteran must be. Property Taxes In Texas For Veterans.

From va-kreeg.blogspot.com

√ Does Veterans Pay Property Taxes Va Kreeg Property Taxes In Texas For Veterans Web texas offers a range of homestead exemptions for veterans, providing significant property tax. Web tax code section 11.131 requires an exemption of the total appraised value of homesteads of texas veterans who. You can apply the exemption to any. Web the disabled veteran must be a texas resident and must choose one property to receive the exemption. Web learn. Property Taxes In Texas For Veterans.

From va-kreeg.blogspot.com

√ Does Veterans Pay Property Taxes Va Kreeg Property Taxes In Texas For Veterans Web learn how to apply for property tax exemptions for residence homesteads owned by veterans or surviving family in texas. Web disabled veterans (including surviving spouses and children) applying for exemption under tax code section 11.22. You can apply the exemption to any. Web texas offers a range of homestead exemptions for veterans, providing significant property tax. Web the disabled. Property Taxes In Texas For Veterans.

From www.tucsonareahomesearch.com

Disabled Veteran Property Tax Exemption Property Taxes In Texas For Veterans Web veterans with a 10% or more disa bility rating qualify f or a disabled vetera n exemption. Texas provides for a disabled veteran exemption if the property. You can apply the exemption to any. Web disabled veterans (including surviving spouses and children) applying for exemption under tax code section 11.22. Web disabled veterans and surviving spouses of disabled veterans.. Property Taxes In Texas For Veterans.

From vaclaimsinsider.com

Texas Disabled Veteran Benefits Explained The Insider's Guide Property Taxes In Texas For Veterans Web veterans with a 10% or more disa bility rating qualify f or a disabled vetera n exemption. Texas provides for a disabled veteran exemption if the property. You can apply the exemption to any. Web learn how to apply for property tax exemptions for residence homesteads owned by veterans or surviving family in texas. Web tax code section 11.131. Property Taxes In Texas For Veterans.

From www.youtube.com

Veteran Tax Exemption 100 disabled veteran benefits YouTube Property Taxes In Texas For Veterans Web the disabled veteran must be a texas resident and must choose one property to receive the exemption. Texas provides for a disabled veteran exemption if the property. Web texas offers a range of homestead exemptions for veterans, providing significant property tax. Web disabled veterans (including surviving spouses and children) applying for exemption under tax code section 11.22. Web learn. Property Taxes In Texas For Veterans.

From www.exemptform.com

Senior Citizen Or Disabled Veteran Property Tax Exemption Applicaton Property Taxes In Texas For Veterans Texas provides for a disabled veteran exemption if the property. Web disabled veterans and surviving spouses of disabled veterans. Web the disabled veteran must be a texas resident and must choose one property to receive the exemption. Web texas offers a range of homestead exemptions for veterans, providing significant property tax. Web veterans with a 10% or more disa bility. Property Taxes In Texas For Veterans.

From www.youtube.com

Property Tax Savings for Veterans YouTube Property Taxes In Texas For Veterans You can apply the exemption to any. Web disabled veterans (including surviving spouses and children) applying for exemption under tax code section 11.22. Web texas offers a range of homestead exemptions for veterans, providing significant property tax. Web the disabled veteran must be a texas resident and must choose one property to receive the exemption. Web tax code section 11.131. Property Taxes In Texas For Veterans.

From www.military.net

Which States Offer Disabled Veteran Property Tax Exemptions? Property Taxes In Texas For Veterans Web tax code section 11.131 requires an exemption of the total appraised value of homesteads of texas veterans who. Texas provides for a disabled veteran exemption if the property. Web veterans with a 10% or more disa bility rating qualify f or a disabled vetera n exemption. Web disabled veterans and surviving spouses of disabled veterans. Web the disabled veteran. Property Taxes In Texas For Veterans.

From cck-law.com

Texas State Veteran Benefits Housing, Finance, and More CCK Law Property Taxes In Texas For Veterans Web learn how to apply for property tax exemptions for residence homesteads owned by veterans or surviving family in texas. You can apply the exemption to any. Web texas offers a range of homestead exemptions for veterans, providing significant property tax. Web disabled veterans and surviving spouses of disabled veterans. Web disabled veterans (including surviving spouses and children) applying for. Property Taxes In Texas For Veterans.

From va-kreeg.blogspot.com

√ Does Veterans Pay Property Taxes Va Kreeg Property Taxes In Texas For Veterans You can apply the exemption to any. Web tax code section 11.131 requires an exemption of the total appraised value of homesteads of texas veterans who. Web texas offers a range of homestead exemptions for veterans, providing significant property tax. Web the disabled veteran must be a texas resident and must choose one property to receive the exemption. Web disabled. Property Taxes In Texas For Veterans.

From propertyownersalliance.org

How High Are Property Taxes in Your State? American Property Owners Property Taxes In Texas For Veterans Web texas offers a range of homestead exemptions for veterans, providing significant property tax. You can apply the exemption to any. Web veterans with a 10% or more disa bility rating qualify f or a disabled vetera n exemption. Web tax code section 11.131 requires an exemption of the total appraised value of homesteads of texas veterans who. Web the. Property Taxes In Texas For Veterans.

From www.youtube.com

Texas Veteran Benefits Texas Veteran Property Tax Exemption Property Taxes In Texas For Veterans Web veterans with a 10% or more disa bility rating qualify f or a disabled vetera n exemption. Texas provides for a disabled veteran exemption if the property. Web learn how to apply for property tax exemptions for residence homesteads owned by veterans or surviving family in texas. Web tax code section 11.131 requires an exemption of the total appraised. Property Taxes In Texas For Veterans.

From www.zillow.com

The Highest and Lowest Property Taxes in Texas Property Taxes In Texas For Veterans Web tax code section 11.131 requires an exemption of the total appraised value of homesteads of texas veterans who. Web veterans with a 10% or more disa bility rating qualify f or a disabled vetera n exemption. Web the disabled veteran must be a texas resident and must choose one property to receive the exemption. Web learn how to apply. Property Taxes In Texas For Veterans.

From www.formsbank.com

Fillable Form Otc998 Application For 100 Disabled Veterans Real Property Taxes In Texas For Veterans Web disabled veterans and surviving spouses of disabled veterans. Web texas offers a range of homestead exemptions for veterans, providing significant property tax. Texas provides for a disabled veteran exemption if the property. You can apply the exemption to any. Web the disabled veteran must be a texas resident and must choose one property to receive the exemption. Web disabled. Property Taxes In Texas For Veterans.

From www.youtube.com

Texas Disabled Veteran Property Tax Exemption (EXPLAINED) YouTube Property Taxes In Texas For Veterans You can apply the exemption to any. Web tax code section 11.131 requires an exemption of the total appraised value of homesteads of texas veterans who. Texas provides for a disabled veteran exemption if the property. Web texas offers a range of homestead exemptions for veterans, providing significant property tax. Web learn how to apply for property tax exemptions for. Property Taxes In Texas For Veterans.

From www.pngkey.com

Download Veteran Disability Exemptions By State Texas Property Tax Property Taxes In Texas For Veterans Web disabled veterans (including surviving spouses and children) applying for exemption under tax code section 11.22. Texas provides for a disabled veteran exemption if the property. Web tax code section 11.131 requires an exemption of the total appraised value of homesteads of texas veterans who. Web disabled veterans and surviving spouses of disabled veterans. Web veterans with a 10% or. Property Taxes In Texas For Veterans.